In the global economy, oil remains one of the most essential commodities. It is a key input for chemicals and manufacturing, powering fuel industries, transportation, and supporting electricity generation. As per the International Energy Agency (IEA), the growth of renewable energy, oil still accounts for over 30% of global primary consumption.

Imports are important to keep the economies running for those countries that do not produce enough oil domestically. The import of oil directly influences trade balances, inflation rates, and overall industrial growth. A sudden rise in oil prices can increase fuel costs, food prices, and weaken national currencies. Oil price shocks are one of the biggest risks to economic stability in import-dependent nations, as per the World Bank.

In this article, we will discuss the insights about how the global oil trade works, highlight the world's top oil-importing countries, discover regional and industry-level demand, and discuss the overview of future trends that are further increasing the demand of the oil imports market worldwide.

The international oil trade depends on two major products, which are crude oil and refined petroleum products. Crude oil is unprocessed oil that must be refined into usable fuels such as diesel, gasoline, and jet fuel. Countries with strong refining capacity, such as the United States and China, import crude oil rather than finished products because it is affordable and offers flexibility. Nations with limited refineries, like Japan, rely more on refined fuel imports. According to the U.S. Energy Information Administration (EIA), refining capacity plays a major role in shaping import strategies.

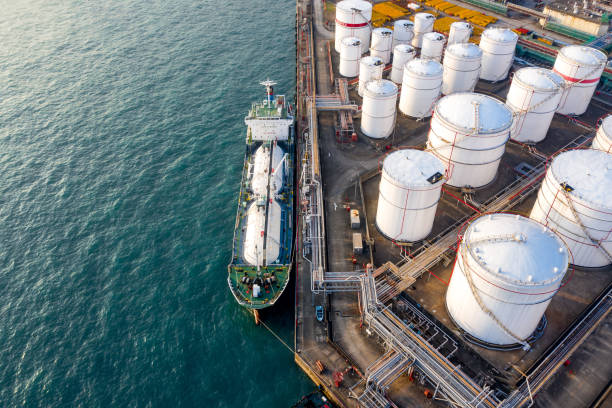

Most oil exports come from regions with abundant resources. The Middle East is the main supplier, especially the UAE, Iraq, and Saudi Arabia. Russia and Central Asia have supplied Europe and Asia for many years. Africa, with countries like Nigeria and Angola, and the Americas, including Canada and Brazil, are also important exporters. Oil is transported by tankers and pipelines, and major routes like the Strait of Hormuz, Suez Canal, and Strait of Malacca carry almost 40% of the world's oil trade.

Below is the list of country-wise oil import analysis:

|

Rank |

Country |

Gross Oil Imports (million bpd) |

|

1 |

China |

11.1 |

|

2 |

United States |

8.42 |

|

3 |

India |

4.8 |

|

4 |

Japan |

2.6 |

|

5 |

South Korea |

2.6 |

|

6 |

Netherlands |

2.1 |

|

7 |

Germany |

1.9 |

|

8 |

Singapore |

1.6 |

|

9 |

Spain |

1.5 |

|

10 |

France |

1.4 |

Source: https://grokipedia.com/page/List_of_countries_by_oil_imports

China is the largest importer of oil worldwide, importing above 11 million barrels per day. The country's demand stems from industries like manufacturing, transport, and the petrochemical industries. Another aspect concerning China’s petroleum aspect is that the government takes serious measures to secure oil supply by creating petroleum strategic reservoirs. These are derived from countries like Saudi Arabia, Iraq, and Russia.

The United States is one of the world’s top oil importers, even though it produces a lot of oil itself. In 2023, the U.S. brought in about 6 to 7 million barrels of oil each day to supply its refineries. While shale oil production has reduced the country’s need for imports, the U.S. still brings in oil for blending. Most of these imports come from Canada, Mexico, and Saudi Arabia.

The oil demands in India are increasing because of the rising population. The Indian Government imports over 85% of its oil requirements from the Middle East. The Government strategies are based on diversifying their sources and expanding refining capacity.

Japan relies on imported oil for all its oil requirements, except for a few, as it has negligible oil production within the country. More than 90% of its imported oil comes from the Middle East.

The EU countries are major importers and have managed to diversify their sources of supply with a focus on reducing dependence on Russian oil. The imports include shipments from Norway, the U.S., and the Middle East. Energy security is a priority in energy policy.

Transportation relies heavily on imported oil. The aviation, shipping, and road transport sectors use gasoline, diesel, and jet fuel. The international transport sector accounts for approximately 60% of oil consumption.

Industries such as steel, cement, and chemicals are dependent on oil-based fuels and feedstocks. Developing countries depend on imported oil to facilitate their industrial growth and exports.

In certain developing countries, oil-fired power stations are still used as reserve power sources in cases of peak or scarcity.

Oil is an important raw material for producing plastics, fertilizers, and synthetic products. Demand for petrochemicals is increasing, even as demand for fuels gradually falls.

The following are the key factors that are affecting oil importation.

The global oil prices have a significant effect on inflation. When oil prices are high, it sparks an increase in the costs of transportation and production of goods and/or services. Higher fuel prices have effects on food chains, transportation, and electricity bills of countries that import oil.

An increase in the cost of importing oil leads to an increase in a country’s trade deficit, especially for countries that use a lot of foreign oil. This leads to a depletion of foreign exchange reserves in a country and can result in a country being able to spend less on development projects and social programs. For developing countries, importing oil is usually one of their highest import items.

Oil is traded worldwide in US dollars. When the local currencies depreciate against the US dollar, the price of imported oil rises, although the international price of oil stays unchanged. Among emerging markets, local currencies' fluctuations against the US dollar pose major risks. As a result, governments must also pay fuel subsidies or increase fuel prices.

Instability in the top oil-producing countries can affect supply chain management. Conflicts in the Middle East, the imposition of sanctions on countries that produce oil, or even certain tensions in the region, are usually responsible for supply chain breakdowns as well as steep prices.

International sanctions may also limit the supply of oil or compel the importer to seek alternative sources of supply, albeit at a different cost structure. It is vital to consider the structure of the cost of alternative supplies due to the varying nature of the affected country’s conditions.

Therefore, decisions taken by OPEC on levels of output directly affect global supply levels and subsequent pricing. Decreased output levels may lead to tight supply levels and higher pricing, while increased output levels may ease the pressure on supply. Countries that import oil always monitor these policies.

In order to minimize vulnerability, states tend to hold strategic petroleum reserves, diversify sources, and enter into long-term contracts. By this, the states can protect their economies from any sudden changes in the international crude oil market. Thus, the combined forces of economic considerations and geopolitical variables make importation of the commodity an important policy maker's consideration for all countries.

|

Risk |

Impact |

|

Supply Chain Disruptions |

Delays and shortages in oil delivery due to port closures, pipeline outages, or geopolitical events. |

|

Price Volatility |

Increased inflation and budget pressure from sudden changes in global oil prices. |

|

Single-Supplier Dependence |

Higher energy security risks if reliant on one country or region for imports. |

|

Environmental Regulations |

Higher compliance costs for cleaner fuels and emissions standards. |

|

Geopolitical Conflicts |

Supply interruptions and price spikes from wars, sanctions, or disputes. |

|

Infrastructure Limitations |

Delays and higher costs due to limited ports, pipelines, or storage capacity. |

The focus on clean or renewable sources of energy is gradually bringing about a change in the ways and means adopted by oil-importing nations in managing their requirements for energy. Many developed nations have injected massive capital into the development of other sources of energy like solar, wind, and even hydroelectricity to shift their reliance away from importing oil. Another major factor contributing to this shift is the growing popularity of electric cars or EVs.

With the rising popularity of EVs, the demand for gasoline as well as diesel is likely to fall, especially in countries like the US, Germany, and Japan. Nevertheless, the role of oil imports will not diminish in the near future. The transportation sector, for example, including aviation, maritime, and freight transportation, would depend largely on oil-based products. Industrial development, such as chemicals, plastics, and other manufacturing processes, would necessarily continue using oil-based products.

Most new countries would not yet have developed sufficient infrastructure for the use of new, renewable forms of energy, and as such, oil imports would help fuel development. The role of strategic oil reserves would, therefore, remain important. Although oil consumption would eventually decline, the goal would remain for a smooth flow of oil imports.

The period between 2025 and 2035 will see lower growth in world oil demand, although this will not cease. The greatest growth in imports will be in the countries with emerging economies, especially in Asia and Africa. The main factor influencing this rise will be the higher consumption levels in countries such as India, Indonesia, and Vietnam, as well as in Africa, because these countries will continue to depend on imports to satisfy this need, as they will not be producing. At the same time, the degree of oil imports in more developed countries is expected to see a steady decline.

This would result from better fuel efficiency norms, the growing popularity of electric vehicles, and more stringent environmental protection policies in countries such as Europe, Japan, and parts of North America. However, oil would remain a critically important material from a strategic standpoint until the end of 2035. This would include its demand in the production of petrochemical products, for airline transportation, and for heavy manufacturing.

Oil imports have continued to influence global trade, the stability of the economy, and security in the energy sector. Although renewable energy sources are on the rise, it is important to recognize that oil is still an essential commodity in the transportation and industrial sectors. Nations that have multiple sources of supply and develop energy strategies will be able to counter risks in the sector.

Rice is one of the most staple food crops worldwide. It's also in high demand, but its market is small comp

READ FULLWhen people hear about textiles, they often conjure up the image of clothing. But textile is not just about

READ FULLWhat Are Soybeans? Belonging to the pea family, soybeans are a kind of legume that has

READ FULL